Smart Expatriation

Discover Smart Expatriation, our exclusive online solution that allows you to easily and reliably calculate the compensation of your expatriates.

Smart Expatriation, the online international compensation calculator

Determining fair compensation for internationally mobile employees is not an easy task for HR departments, as a number of factors affect expatriate salaries: the cost of living at the destination, the cost of housing, taxes, social security contributions, and so on. In addition, there are questions about the total cost of a company's mobility projects and how best to optimize them.

To support HR professionals and business leaders, Helma has created Smart Expatriation, an online international compensation calculator. Our digital tool is based on data collected in the field by local experts, to help you estimate the cost of sending your employees abroad. You can use this tool on your own or with the help of our Advisory department, integrating the elements of your international mobility policy for personalized, reliable results.

Compensation Calculation

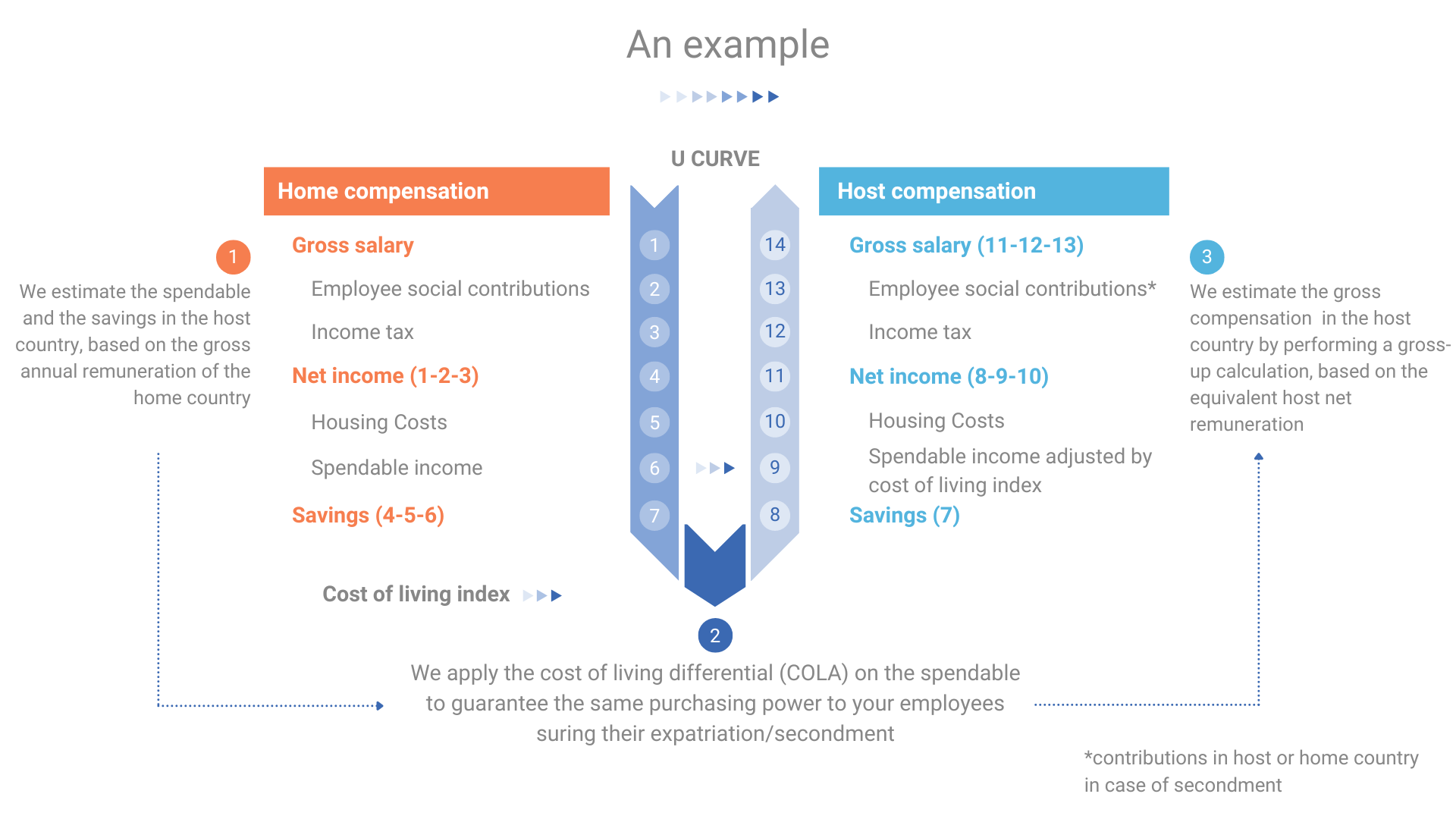

Smart Expatriation uses the U-shaped calculation method (balance sheet approach). Taking the salary in the home country as a reference, the calculator determines the equivalent remuneration that guarantees the same amount of savings for your employee in the host country. Living and accommodation costs, taxes, compulsory social security contributions... Everything is included in the calculation. So your expatriate employees maintain the same standard of living abroad.

Datas on the cost of living

The cost of living varies greatly from one destination to another, and even from one city to another within the same country. Smart Expatriation enables you to anticipate the budget for expenses abroad and define the amount of the COLA (Cost of Living Allowance) bonus you can allocate to your expatriate employees.

Our calculator analyzes and compares the median prices of the main items of daily living expenses (catering, food, energy, transport, clothing, leisure, etc.). These data are collected in more than 200 localities and updated twice a year. Two cost of living indices are used to adapt to the consumption patterns of expatriates (Local index or Expat index). The results vary depending on the exchange rate at the time of simulation.

Specify the place of departure and destination, select the type of calculation index, and you immediately access your detailed report online.

Employer Cost Calculation

Smart Expatriation allows you to calculate the employer costs of an expatriation by destination and over the entire mobility period. With just a few clicks, you get :

- The calculation of housing costs,

- The cost of living differential,

- The amount of compulsory social security contributions you will have to pay.

With this information, you can refine your consideration of the expatriate's status, which favors secondment or expatriation for social security purposes. You can also define an attractive expatriation package for your expatriate and his family. All this information is gathered in a clear report that can be easily used by your HR and finance departments. You will always benefit from the support of our consulting department to optimize your employer costs.

Housing Grid

The percentage spent on housing varies greatly depending on the expatriate's family situation and destination. To estimate the housing budget, Smart Expatriation offers a complete and accurate view of the local rental market. These studies are updated every 6 months by local experts to reflect the realities of the market. They include:

- Monthly rental budgets in local currency for empty or furnished properties from 1 to 4 bedrooms and according to 2 levels of service,

- The main terms of the lease and the additional costs to be expected at the time of signing,

- Key information about the local market and expats' preferred neighborhoods.

Calculation of taxes and social contributions

Smart Expatriation calculates the amount of income tax to be paid by your employee in the destination country. All you have to do is enter the employee's gross salary or the amount of tax in the country of origin, and the system automatically calculates the social security contributions and taxes in the host country.

International taxation also has a strong impact on your business and our calculator cannot replace the opinion of an expert to optimize the cost of mobility abroad. Our Advisory department will work with you to implement the best tax optimization practices for each destination.

The advantages of Smart Expatriation

Our international compensation calculator is recognized by international mobility professionals for the robustness of its algorithms and the reliability of its data, which is collected locally by our international partners. Easy to use, you can run it independently and get detailed reports in moments.

With Smart Expatriation, you can offer your employees a motivating package while optimizing your employer's costs. Our tax experts are available to advise and assist you in the realization of various simulations.